puerto rico tax incentives 2021

Sunday July 25 2021 - 1200. Read more about.

Supreme Court Seems Divided Over Puerto Rico S Exclusion From Federal Benefits

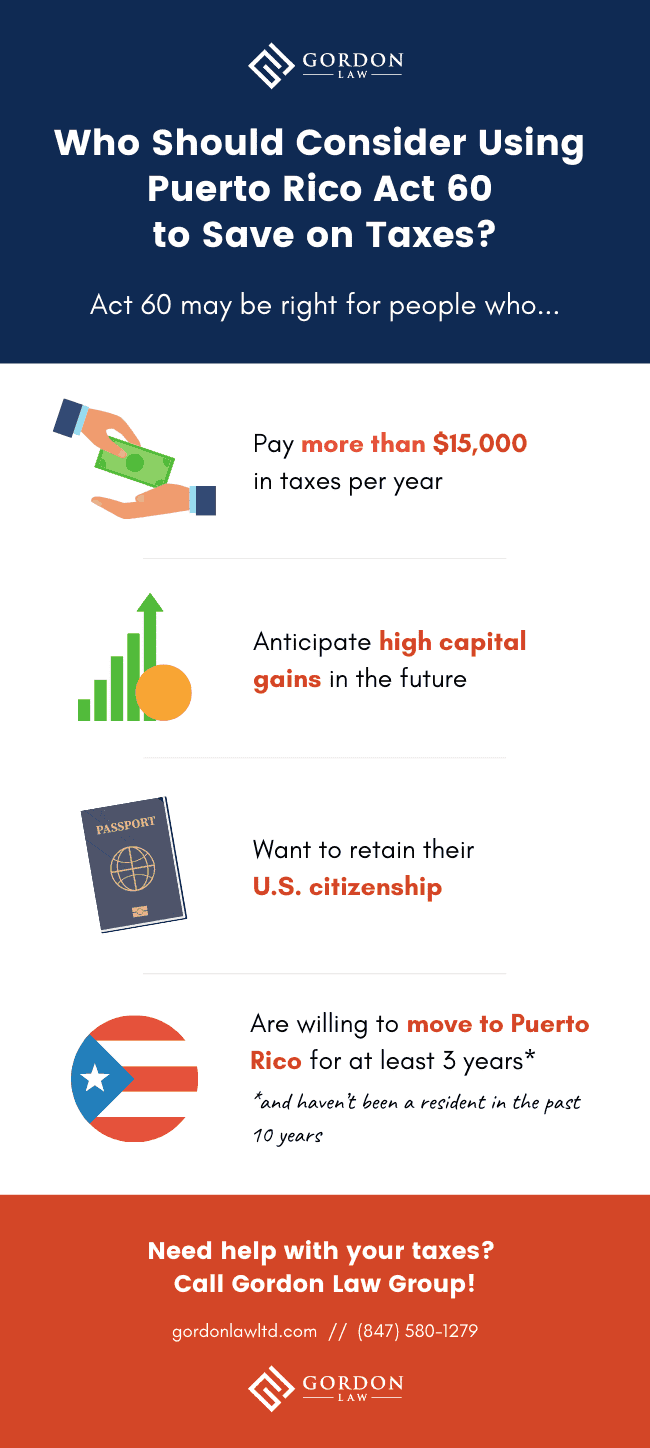

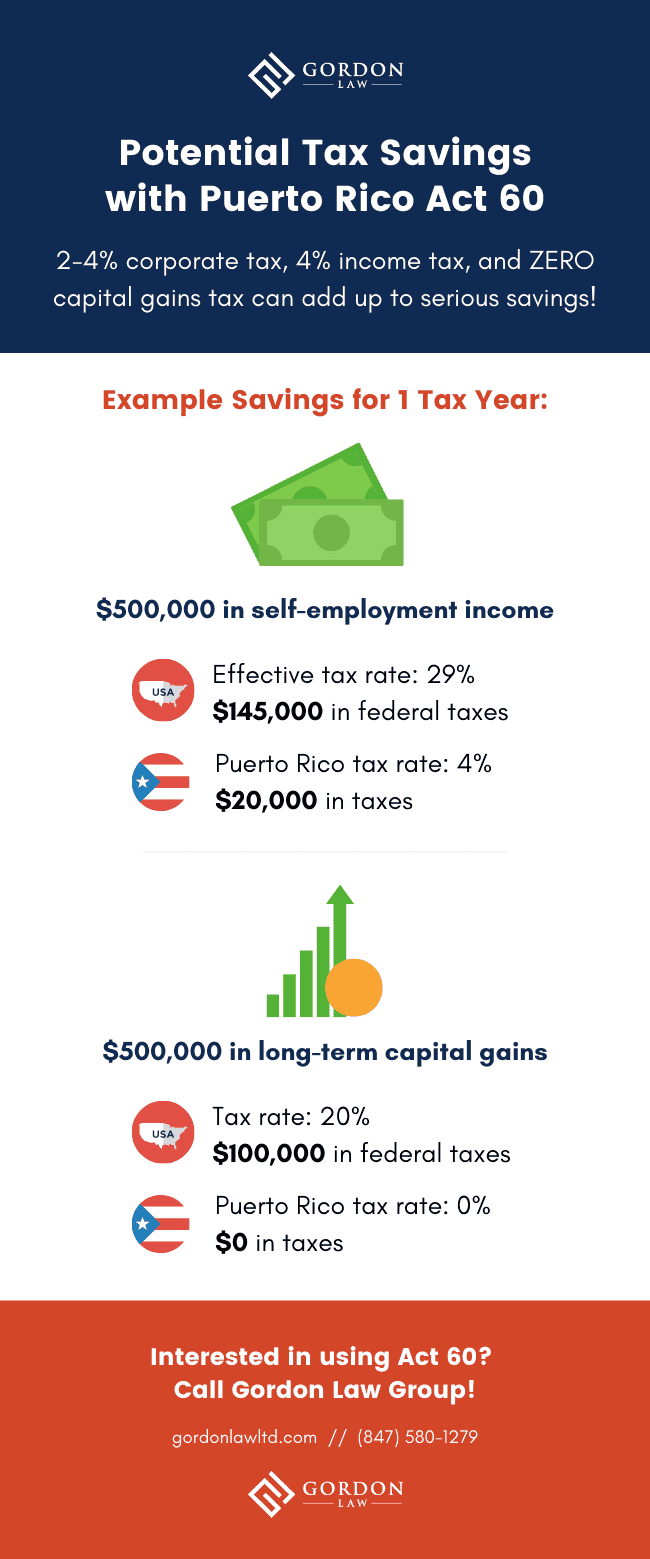

Further Chapter 2 of the Incentives Act offers tax incentives to individuals who relocate to Puerto Rico.

. More importantly the requirements for each program have been adjusted. Typically the company engages in providing services to customers outside of Puerto. Act 20 Export Services Act.

In many if not most cases you must file taxes in two places with the IRS and with the Puerto Rico Department of Finance. The report also found that Act 20 led to 12 billion in investment and 36222 new jobs. A bona-fide resident of Puerto Rico can avoid including all or part of the income or dividends from the company in US.

Over 9000 but not over 25000. It is deeply troubling to learn that wealthy individuals are using Puerto Rico as a tax haven to avoid paying their fair share Democratic New York Rep. This Code is approved with the conviction that it shall improve Puerto Ricos economic competitiveness.

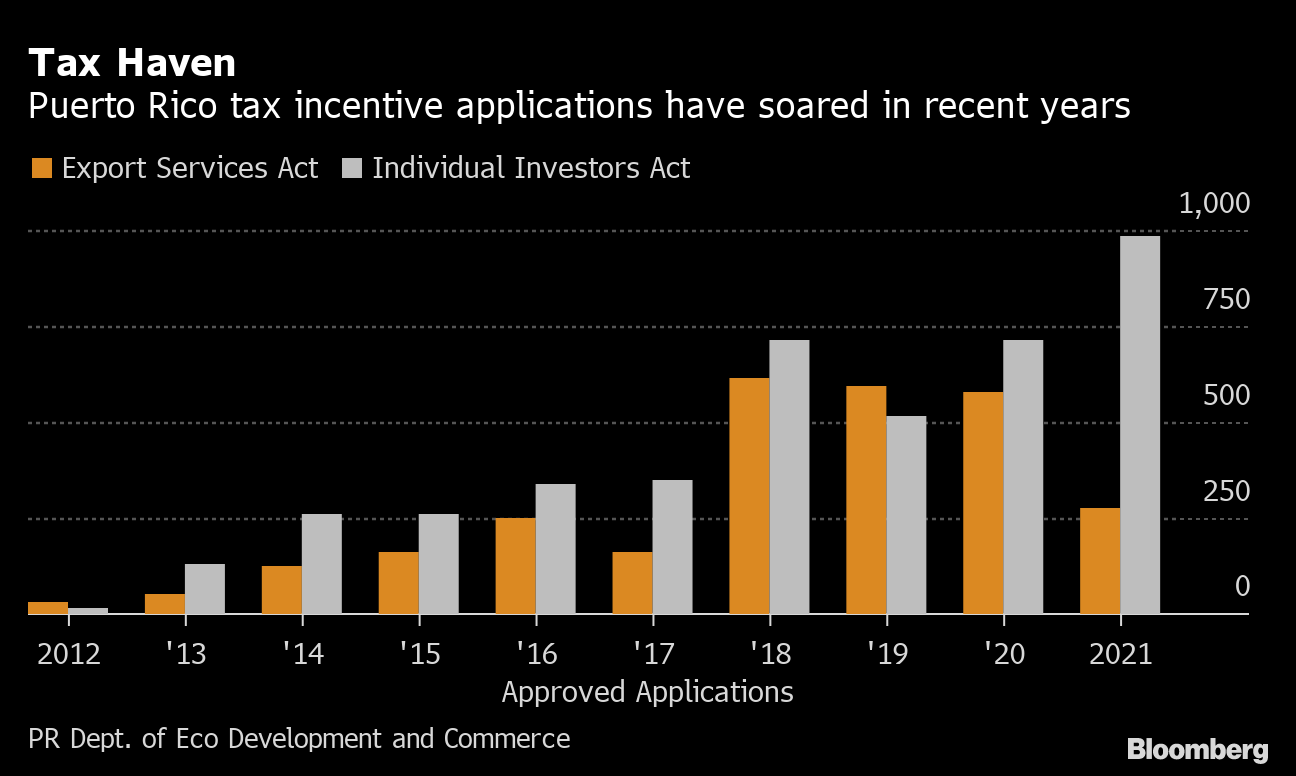

2021 has seen record gains in the stock market and many. Also during the year 2012 two additional laws were enacted. You should use common sense and rely on your own legal counsel for a formal legal opinion on Puerto Ricos tax incentives maintaining bona fide residence in Puerto Rico and any other issues related to taxes or residency in Puerto Rico.

The credit will range from 5 to 125 of the gross earned income subject to limitations depending on the amount of dependants claimed by the taxpayer. 22-2016 provides up to 11 energy credit if the tourism activity is endorsed by the PRTC and complies with the requirement stated in this form. Net taxable income USD Tax.

7 of the excess over USD 9000. The 2008 Economic Incentives for the Development of Puerto Rico Act EIA provides a wide array of tax credits and incentives that enable local and foreign companies dedicated to certain business activities to operate within Puerto Rico. As provided by Act 60.

To promote the necessary conditions to attract investment from industries support small and medium merchants face challenges in medical care and education simplify processes optimize and provide greater transparency Act 60-2019 was signed which establishes the new Puerto Rico Incentive Code. The tax incentive program which was first created as the 2012 Act 20 and Act 22 programs could not have come at a better time as President Biden prepares to announce the largest federal tax hike since 1993. Tax and incentives guide.

More recently these two acts were updated and combined in a new law called Act 60. Act 20 also known as the Export Service Act targets certain service businesses by offering corporate tax rates as a low 4 to qualifying corporations that relocate to the jurisdiction. Under this new law known as the Incentives Code Acts 20 and 22 have been consolidated into Act 60 and were subsequently renamed.

Form 8898 requires the taxpayer to provide information concerning compliance with the above requirements. Act 60 consolidated various tax decrees incentives subsidies and benefits including Acts 20 and 22. The taxpayer moving to Puerto Rico is required to file Form 8898 with the IRS and file Form 1040 for the year of move.

Why Are Americans Choosing to Move to Puerto Rico Under Act 60. Those two tax acts offer low to no taxes on certain types of income. The purpose of Act 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks.

Whats new in 2021 for Puerto Ricos Tax Incentives. The Tax Incentives Office provides assistance to the Economic Development Bank of Puerto Rico in evaluating the loan applications for the development of tourism activities. Act 22 Individual Investors Act.

It systematizes dozens of incentive acts Acts 20 and 22 are just the most famous ones that Puerto Rico has. The incentives are particularly attractive to US. Personal income tax rates.

The countrys tax collector quietly launched a coordinated campaign in late January to examine individuals who took advantage starting in 2012 of tax incentives designed to lure high net-worth. Citizens who move to Puerto Rico because they do not need a residency permit their Puerto Rico sourced income is exempt from US. Over 25000 but not over 41500.

For taxable years beginning after 31 December 2019 taxpayers who are residents of Puerto Rico during the entire year who are 27 years old and beyond will be entitled to claim the EIC. The two most popular programs offered by the Puerto Rican government are Act 20 and Act 22. 0 capital gain tax for Puerto Rico residents.

PRelocate does not assume any responsibility for the contents of or the. The new law does NOT eliminate the existing incentives. Purpose of Puerto Rico Incentives Code Act 60.

Legacy Act 20 generally provides for a 4 tax rate on income from specified export activity. Local government has legislated a series of incentives to attract investment of which EB-5 Visa program participants can also take advantage. The Tax Incentive Code known as Act 60 provides tax exemptions to businesses and investors that relocate to or are established in Puerto Rico.

In June 2019 Puerto Rico made substantial changes to its tax incentives that came into effect on January 1 2020. The Incentives in a Nutshell. Beneficiaries invested roughly 13 billion in real estate between 2015 and 2019.

Still Puerto Rico hopes to lure American mainlanders with an income tax. The following regular tax rates remain in effect for 2018 and future years. 4 corporate tax rate for Puerto Rico services companies.

Benefits of establishing relocating or expanding businesses in Puerto Rico. The Code shall create a simple streamlined. In 2008 a new Economic Incentives Act for the Development of Puerto Rico herein after Act 73 or Economic Incentives Act went into effect.

Acts 20 and 22 were intended to incentivize investment in Puerto Rico promote the exportation of. In late June 2019 Puerto Rico completed a massive overhaul of their tax incentives enacting the Incentives Code. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here.

Act 20 and Act 22 promoting the export of services from Puerto Rico and the transfer of wealthy individuals to Puerto Rico. Puerto Rico enjoys fiscal autonomy which means that it can offer very attractive tax incentives not available on the mainland US with the advantages of being in a US. 27 2021 the Internal Revenue Service IRS announced a new compliance campaign focusing on the Puerto Rico Act 22 now Act 60.

Puerto Rico - Green Energy Fund Tier I Incentive Program. Puerto Rico offers the security and stability of operating in a US jurisdiction with an array of special tax incentives for foreign direct investment that can be found nowhere else in the world.

Crypto Rich Are Moving To Puerto Rico World S New Luxury Tax Haven Bloomberg

Guide To Income Tax In Puerto Rico

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

Puerto Rico Tax Haven Is Alluring But Are There Tax Risks

Big Shot Lawyers Lured By Beaches And 4 Tax Rate To Puerto Rico Wealth Management

Filing Your 2021 Tax Return In Puerto Rico

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Tax Incentives Is Relocating To Puerto Rico The Right Move For You

Guide To Income Tax In Puerto Rico

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

More Biotechs Attracted To Puerto Rico Bioprocess Insiderbioprocess International

Puerto Rico Offers The Lowest Effective Corporate Income Tax

Sm Best Places Pr Report Puerto Rico Person Federal Income Tax

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

Puerto Rico Tax Act 60 Business Opportunities And Tax Incentives In The Caribbean

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Should You Be Moving To Puerto Rico To Save Tax Global Expat Advisors

Us Tax Filing And Advantages For Americans Living In Puerto Rico